Some companies will exhibit behaviors listed below in the coming year, if they aren't already. My hope in sharing these thoughts is that each of you can navigate your next career moves with a little more context - though I suspect most of you have already considered these things.

The world can turn around rapidly, so these things will be invalid in the case that this is just a blip - I hope it is.

tl;dr

- Tech sector valuations are getting crushed, attractive exits are further away

- Private valuations will fall like public ones, though the indicators lag behind

- Harder to raise money means higher dilution, less attractive comp packages

- Starting a company gets more attractive since opportunity cost is lower

- Taking a sabbatical gets more attractive since opportunity cost is lower

- Layoffs and non-optimal comp packages are a risk if you are considering moving companies in the near term since you'll be the last person hired (e.g. Workrise)

- We've worked in one of the hottest fields, during one of the most exuberant periods in history. That is changing quickly, though the personal impact is lagging the macro. Expect it to catch up if things continue to deteriorate

Let's continue

Markets are down - in particular the tech sector has gotten crushed. All of this is par for course after the intense bull run we've had post-2008 and the huge investment in tech companies over the past decade. I'm not a macroeconomist, but I am certain at least some of these things will be true. Many investors have been communicating this way for months now; encouraging founders to raise as fast as they can.

The bad news

- Companies raising emergency rounds (or that raised huge previous rounds) are going to have a long time before a new round of funding is an economically feasible option

- Companies that raise in the next 12 to 24 months will likely have term sheets much less favorable than we've seen in our careers, aka heavier dilution for employees

- Changing jobs right now means you're first to go in many layoff scenarios

- Changing jobs right now means you'll likely be sold equity packages that sound better than reality and are probably based on lagging metrics such as the valuation at the previous round. See the 2nd image below to illustrate

- Cash is going to get tighter which may impact base and bonus structure

The good news

- Starting a company can be more attractive during a bear market because your opportunity cost goes down

- Starting a company via Y Combinator is actually more attractive as their fixed rate cash/equity doesn't factor in the macro environment. I.e. you get 500k for 6% even when the macro looks bad

- For comp negotiation, you might have better luck pushing for non-financial levers like PTO or schedule flexibility

- Strong companies are going to continue hiring and attract people from the weak

- Less-optimal comp packages are hardly a bad thing considering they will still likely be better than our peers in other industries

At the macro level

- Fundraising is going to get much harder

- Down rounds will happen, and some companies without enough runway won't make it

- Cash is getting much more expensive, aka more dilution and many early and late stage startups have never lived in this environment, so expect some new, potentially negative decisions from companies

- ARR is going to get harder to maintain and grow. If your product isn't a necessary expense, clients will consider cutting you. At minimum, expect all clients to try to renegotiate contracts at lower prices. ARR will naturally be impacted

Tactical tips

- If recruiting, be pointed in asking for all the financials you can, focus on cash balance, burn rate, ARR, based on how positively people respond you can make a more informed decision

- Consider flexibility on financial comp, and ask for PTO or benefits

- If you negotiate, try to use real data like levels.fyi and have multiple offers

- Like I mentioned, some of the impacts on hiring/comp are lagging, so you might have success in the job market for several more months

---

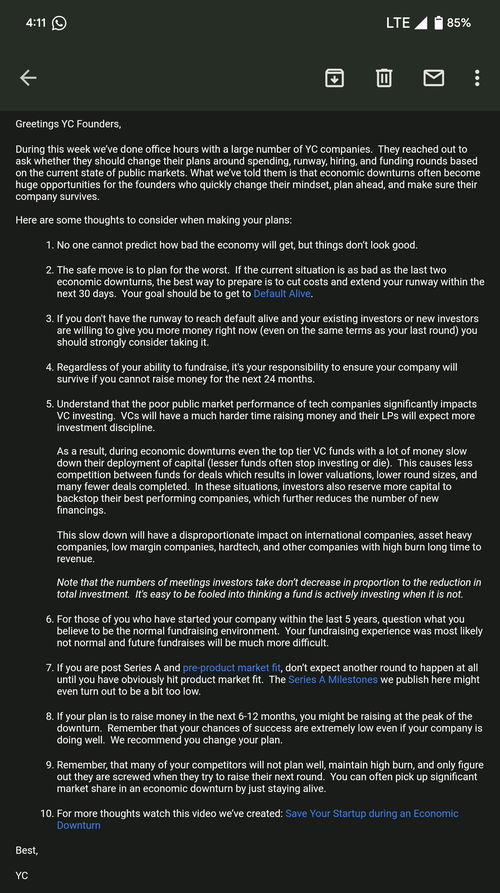

I've attached a note that I saw on Twitter - the main message from YC to founders is to prepare for the worst. While you may or may not be a founder, the financial implications for the leaders of each of our companies means change for us in the workforce. Additionally, I've attached a note of a theoretical example for illustration.

---

Example funding scenario